Top Guidelines Of Transaction Advisory Services

Wiki Article

Transaction Advisory Services - Questions

Table of ContentsThe 8-Minute Rule for Transaction Advisory ServicesSome Known Facts About Transaction Advisory Services.Top Guidelines Of Transaction Advisory ServicesThe Of Transaction Advisory ServicesTransaction Advisory Services for Dummies

This action sees to it the organization looks its ideal to possible purchasers. Getting the company's worth right is crucial for an effective sale. Advisors utilize various methods, like discounted capital (DCF) evaluation, contrasting with comparable business, and current transactions, to find out the reasonable market value. This assists establish a reasonable price and discuss effectively with future customers.Deal advisors action in to aid by getting all the required details organized, responding to questions from buyers, and arranging sees to the business's place. This develops count on with buyers and maintains the sale moving along. Getting the finest terms is essential. Transaction advisors utilize their proficiency to help local business owner take care of challenging arrangements, meet customer assumptions, and framework deals that match the owner's objectives.

Meeting legal guidelines is vital in any kind of company sale. Transaction advisory solutions collaborate with legal specialists to produce and review agreements, arrangements, and other lawful documents. This decreases dangers and sees to it the sale follows the law. The duty of transaction experts expands beyond the sale. They assist company owners in preparing for their next steps, whether it's retirement, beginning a new venture, or managing their newfound riches.

Deal consultants bring a wide range of experience and expertise, guaranteeing that every facet of the sale is handled skillfully. With critical prep work, evaluation, and negotiation, TAS assists entrepreneur accomplish the highest feasible sale cost. By guaranteeing lawful and regulative compliance and handling due persistance alongside various other bargain staff member, transaction consultants reduce prospective risks and liabilities.

Indicators on Transaction Advisory Services You Need To Know

By comparison, Large 4 TS groups: Service (e.g., when a potential buyer is conducting due diligence, or when an offer is closing and the buyer requires to incorporate the firm and re-value the seller's Equilibrium Sheet). Are with charges that are not connected to the bargain shutting efficiently. Make charges per interaction someplace in the, which is much less than what financial investment financial institutions gain even on "tiny offers" (but the collection chance is likewise much higher).

, but they'll focus much more on accounting and evaluation and less on subjects like LBO modeling., and "accounting professional just" topics like trial equilibriums and how to stroll via events utilizing debits and credit reports instead than economic statement modifications.

The Buzz on Transaction Advisory Services

that show how both metrics have actually changed based upon items, networks, and consumers. to judge the accuracy of administration's previous forecasts., consisting of aging, supply by item, average levels, and stipulations. to identify whether they're completely fictional or somewhat credible. Specialists in the TS/ FDD teams might additionally interview management regarding every little thing above, and they'll write a detailed record with their searchings for at the end of the procedure.The power structure in Transaction Services varies a bit from the ones in financial investment banking and exclusive equity professions, and the general shape appears like this: The entry-level role, where you do a great deal of data and monetary evaluation (2 years for a promotion from below). The following degree up; comparable work, but you get the more intriguing bits (3 years for a promo).

Particularly, it's tough to get promoted past the Supervisor degree due to the fact that few individuals leave the task at that phase, and you need to start showing proof of your ability to produce earnings to breakthrough. Allow's begin with the hours and way of living since those are much easier to describe:. There are periodic late nights and weekend work, however absolutely nothing like the frenzied nature of financial investment banking.

There are cost-of-living adjustments, so anticipate reduced compensation if you're in a less expensive location outside major economic (Transaction Advisory Services). For all positions other than Companion, the base pay consists of the mass of the complete settlement; the year-end perk may be a max of 30% of your base pay. Commonly, the most effective means to enhance your earnings is to change to a various firm and negotiate for a greater wage and bonus offer

Fascination About Transaction Advisory Services

You can enter corporate development, yet financial investment banking obtains harder at this phase due to the fact that you'll be over-qualified for Expert roles. Corporate money is still a choice. At this stage, you must just remain and make like this a run for a Partner-level role. If you desire to leave, possibly move to a client and perform their evaluations and due diligence in-house.The major problem is that due to the fact that: You typically need to join one more Big 4 group, such as audit, and work there for a few years and afterwards move into TS, job there for a couple of Transaction Advisory Services years and afterwards move into IB. And there's still no guarantee of winning this IB role since it depends on your area, customers, and the employing market at the time.

Longer-term, there is also some threat of and due to the fact that assessing a company's historic economic info is not precisely brain surgery. Yes, people will always require to be look at here involved, however with even more innovative innovation, reduced headcounts can potentially support client interactions. That said, the Transaction Services team defeats audit in regards to pay, work, and departure chances.

If you liked this post, you may be thinking about reading.

The Best Guide To Transaction Advisory Services

Establish advanced monetary frameworks that assist in determining the actual market price of a company. Give advising operate in connection to company evaluation to aid in bargaining and rates structures. Explain one of the most suitable kind of the bargain and the sort of factor to consider to employ (money, stock, earn out, and others).

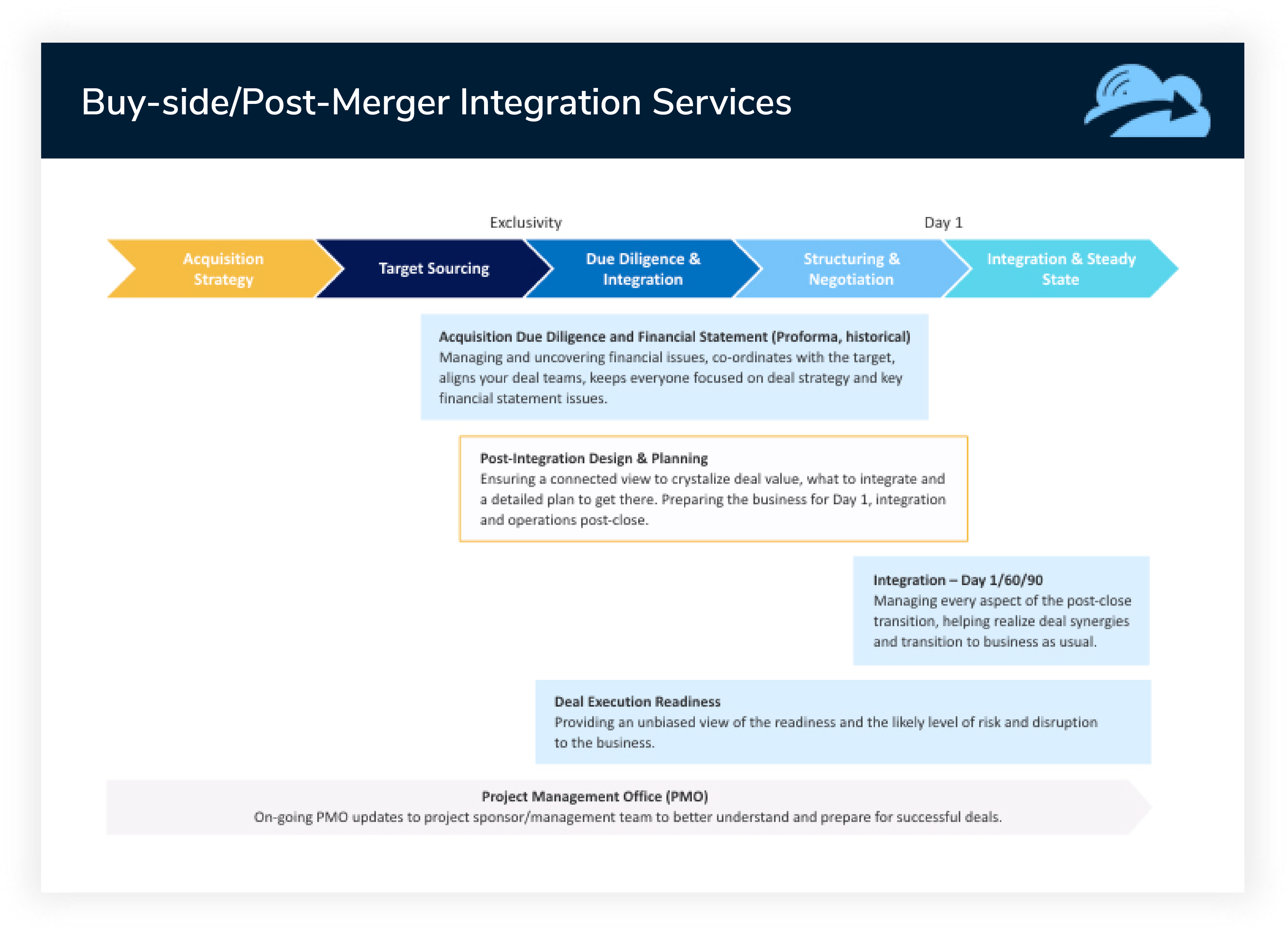

Perform assimilation preparation to figure out the procedure, system, and business changes that may be required after the bargain. Establish standards for incorporating departments, innovations, and company procedures.

Determine potential decreases by lowering DPO, DIO, and DSO. Examine the potential customer base, sector verticals, and sales cycle. Take into consideration the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The functional due persistance uses crucial insights right into the functioning of the firm to be acquired worrying risk analysis and value production. Recognize short-term alterations to funds, banks, and systems.

Report this wiki page